XAUUSD

Gold came under pressure following the confirmation of the Fed's determined stance in fighting inflation in the FOMC minutes released last night. The message that interest rates may remain high for longer than expected triggered selling in non-yielding Gold. The global PMI data to be released today and Powell's speech tomorrow will continue to be decisive for the direction of Gold. Weak PMI data could increase global recession concerns, bringing some demand to Gold, but the main direction will be determined by expectations regarding the Fed.

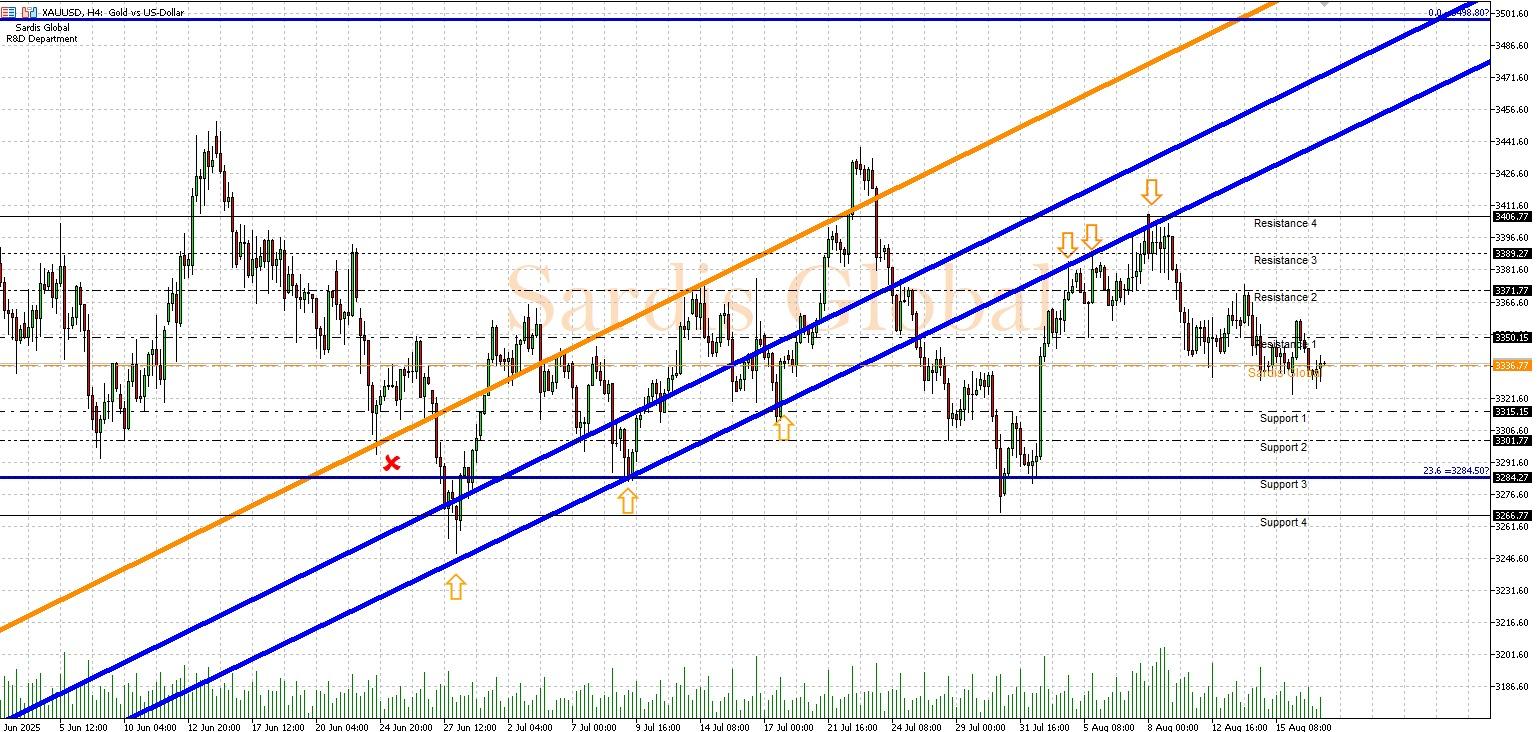

Technical Levels: 3,250.00 - 3,236.77 - 3,215.15 - 3,201.77 - 3,185.00 - 3,160.50 - 3,140.00

Technical Comment: The hawkish FOMC minutes caused a break of the 3,236.77 pivot. Prices are currently testing the main support at 3,201.77. A close below this level could lead to a deepening of sales towards 3,185.00 and 3,160.50 levels. On upward reactions, the levels of 3,215.15 and 3,236.77 will act as resistance.